The Affordable Care Act (ACA) requires health insurers who participate in the ACA exchanges to submit their proposed premium rates for the upcoming plan year. Generally, those rates are available in July, compiled by Healthcare.gov, and made publicly available in August.

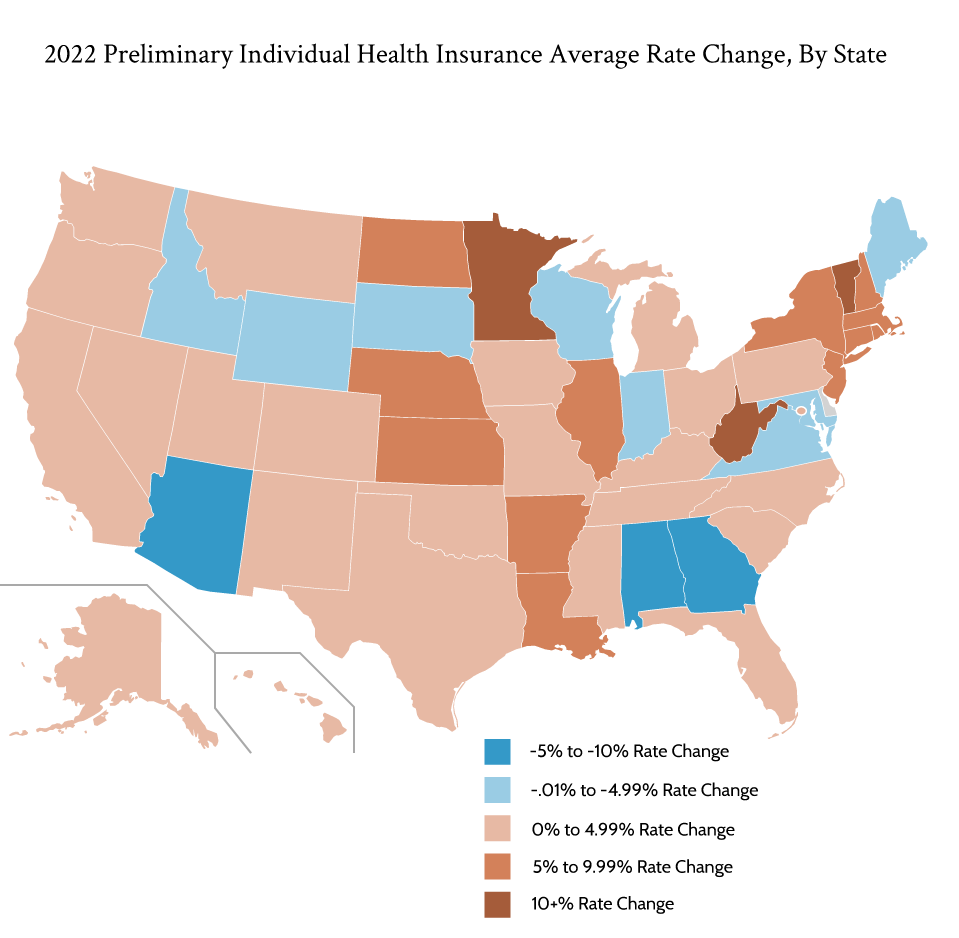

Here’s a look at the 2022 Preliminary ACA Premium Rates:

2022 Average Health Insurance Rate Increases

Healthcare.gov generally collects the following data:

- Plan-level Data — This data shows the high-level data for each carrier’s plan and the requested rate change for that plan. For example, in Alabama, Blue Cross Blue Shield of Alabama submitted plan information for 10 plans. Each plan has a suggested rate increase as well as documentation around that rate increase.

- Carrier-level Data — Healthcare.gov then combines that plan-level data and calculates an insurance carrier-level average premium rate change.

Note that this data is not based on enrollment. So in many states, for example, one carrier owns a significant market share. And within that carrier, one or two plans may comprise the majority of that market share. A weighted calculation based on enrollment may provide the real-world impact of the proposed rate changes. However, that data is not available. As a result, our average rate change numbers are based only on the number of carriers available in each state and their aggregate reported rate change among all plans in a state.

Also, note that this data includes both on-exchange plan information and off-exchange plan information.

The typical insurance carrier in an ACA exchange has requested a modest premium rate increase of 2.5%. Overall, 11 states saw the average health insurer reduce their premium rates. Georgia, Alabama, and Arizona experienced the biggest average reduction in premium rates at 9.47%, 8.36%, and 7.92% respectively. Georgia recently earned approval for a reinsurance waiver, which likely will drive down the average premium. Two carriers primarily drove Arizona’s significant premium decrease. Bright Health’s significant premium rate decrease – as one of only two carriers in the state – led to Alabama’s premium decrease.

States with Significant Premium Rate Changes

West Virginia, Vermont, and Minnesota, meanwhile, were the only three states whose average premium rate increased by more than 10%. West Virginia’s two insurers proposed 13.32% rate increases, followed by Vermont at 12.46% and Minnesota at 11.65%.

Vermont plans to decouple the state’s individual insurance market from its small employer insurance market. As a result, insurers in the individual market have proposed increased rates. Meanwhile, rates in the small group market decreased based on preliminary rate filings.

In Minnesota, the state’s reinsurance program has not yet been renewed for 2022. As a result, insurers will have to pick up the entire tab for enrollees with high medical bills, something the state had done in the past. That’s led to many insurers in the state increasing premiums to cover those members. In fact, in their justification, Medica indicated: “The vast majority of the rate increase this year is due to the sunset of the state-based reinsurance program. The loss of this program means that carriers like Medica must now build those costs back into premium rates.”

In West Virginia, CareSource cited an increasing number of high-cost providers in their West Virginia network as a primary driver of the significant rate increase. Highmark West Virginia indicated that the higher rate increases were the result of CSR silver loading in 2022. You can learn more about silver loading here.

COVID-19 and 2022 Preliminary ACA Premium Rates

Healthcare.gov also stores supporting documentation insurers submit rationalizing their rate changes. We haven’t reviewed every document and some can be heavily redacted. However, more than one health insurer indicated that their rate changes were predicated in some respect on the ongoing COVID-19 pandemic. Specifically, Oscar Health Plan indicates: “Changes to the overall premium level are needed because of the expected costs introduced to the projected marketplace due to the ongoing COVID-19 pandemic.” Physician’s Health Plan noted, “At the date of this rate filing submission, we acknowledge there is still uncertainty regarding the impact of the COVID-19 pandemic on setting premium rates, including whether the pandemic will increase or decrease costs in 2022 and how soon the recently approved vaccines will impact future experience.”

Most analyses expected healthcare utilization to increase while COVID-19 costs declined in 2021 and 2022 as individuals emerged from the pandemic. However, the delta variant may continue to depress overall healthcare usage while increasing COVID-19-related expenditures.

Vaccination costs also play a role. In their Maine filing, Harvard Pilgrim stated “Our 1Q22 rates do not explicitly reflect any impact related to COVID-19, except to cover the expected vaccine costs, which have been included by increasing claims by 1%.” In Massachusetts, Allways Health Partners wrote “As vaccines become available for younger children, FDA grants approval (on a non-emergency basis) and schools and workplaces implement vaccination requirements, we expect to continue costs associated with vaccination.… As the base period does not include vaccine costs, we are building in approximately 0.7% into our rates for the cost of COVID vaccines.”

Medical Costs and 2022 Preliminary ACA Premium Rates

Most supporting documents with unredacted rate change reasons listed anticipated medical and prescription drug cost inflation as one of the reasons for rate changes. As we mentioned earlier, CareSource specifically pointed to high-cost providers in their West Virginia network. Blue Cross and Blue Shield of Florida stated “Medical Trend: Combined effect of medical provider price increases, utilization changes, medical cost-shifting, specialty pharmacy, and new medical procedures and technology” as a reason for rate changes.

Other insurers listed medical cost trends from 3% to 5%. Overall, increases in health care costs continue to drive up premium rates.

Final rates are generally available in November.

Certifi’s health insurance premium billing and payment solutions help healthcare payers improve member engagement while reducing administrative costs.